Trading and investing started not just years, decades but centuries ago. What have we done with it?

The information available in trading and investing arena is so immense that it puts the market participant in a dilemmatic situation to make simple decision of buy or sell.

This information is either in the form of numbers, structures or simply words. Based on these data, numerous strategies are developed and floated in the market today to act upon.

There is quite a significant difference between trading and investing and that significance is created with the factor of time. It all starts with punching a simple order in system considered as a trade executed. With an intention to make quick profits by taking advantage of time decay, when the position doesn’t work in favor and goes negative, the same trade is being carried forwarded for longer duration of time, in a hope to get the position positive, some day and remaining in denial even though capital is bleeding every single moment. Greed is the reason to enter in markets for some more than usual returns so as to at least beat inflation, whereas existence of fear is clearly not allowing to dilute negative positions to get in book of records. And that’s how most of the investors are born, not by default but with outcome of unfavorable circumstances.

There’s always a debate between different kind of trading strategies and styles. Someone is trading on price action while other is trading on indicators. Few prefer for GANN methods while many look for astrological techniques too. Who is right and who is wrong? The answer is none. In fact, there is no incorrect strategy in market. It’s a subjective experience of every individual towards what works and what doesn’t.

Debate with an indicator-based trader that indicators don’t work and they will prove you that it does and they did make a handsome money from the same. Similarly, argue with a price action trader that it’s not sufficient and they will prove you to ensure that price action is superior than anything else including indicators. And so will a practician of GANN, Fibonacci, Ichimoku, Volume Profile, Elliott wave, Astrological etc. will do and there is no end to it.

So, what makes one more attracted towards these strategies and what makes one go deep into finding the hidden treasure?

It’s the curiosity of exciting claims that portrays end of search to a holy grail and be amongst 1% of winners.

It’s the made-up change in your belief system that what you already have is not sufficient enough to make you successful in markets.

It’s the tease of making you falsely realize, it’s the only way left for you to achieve your goals and destination in stock market.

It’s the perception of shame created in the minds of people that how “simple” and “easy” it is to make money with trading and investing, and yet you are unaware about the same.

It is very likely that the market participants do implement some or the other above-mentioned studies during their trading and investment decisions. In fact, traders and investors merge these studies with their own personal experiences and develop the strategies to gain that edge in the markets. This complicates the entire trading system which is hardly simplified by amateurs to implement in live markets, thereby staying in dilemmatic mindset for eternity.

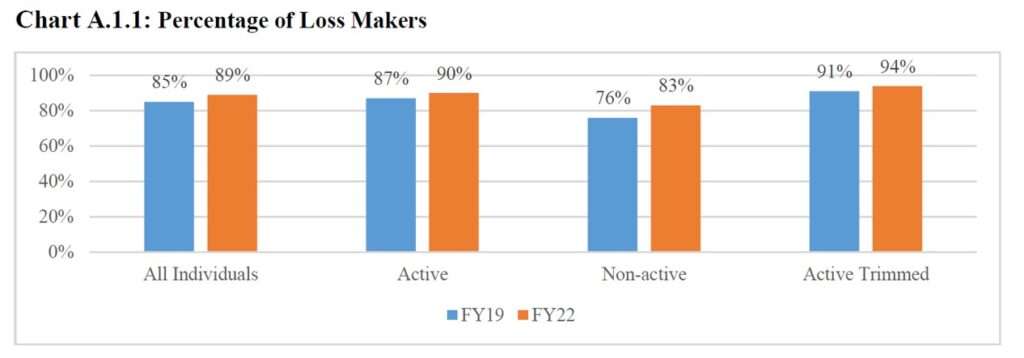

According to recent 2019-2022 study conducted by SEBI’s department of economic and policy analysis; shocking but not surprising facts have been revealed as 89% of the individual traders (i.e. 9 out of 10 individual traders) in equity F&O segment incurred losses6, with an average loss of Rs. 1.1 lakh during FY22, whereas, 90% of the active traders incurred average losses of Rs. 1.25 lakh during the same period.

Please check complete report here:

So, if it’s not the strategies, then what is it that creates the difference?

Strategies exists only to give an edge, and nothing else. How much is the edge, is not a matter of concern too.

It’s everything else apart from strategies, including but not limited to, statistical, psychological, economical, behavioral, internal or external and many more such factors that matters, but paid least importance.

Area of focus is more important than offering of services. That’s why at Virtue Capital, we are more focused on aspects that matter and holds greater significance than anything else. We do not consider strategies to be the determining factors of an objective successful trading decision. If strategies would be the key, then the numbers of SEBI reports would have been something else in this zero-sum-game.

Small things when overlooked or ignored could give rise to bigger problems and that’s why Virtue Capital exists to take care of small things which are paid least importance, however matters the most in the overall picture for better solutions.

Trading and investing started not just years, decades but centuries ago. Now we know what to do with it.

Leave a Reply